Fraud is rarely front and center until it explodes into headlines. Yet, beneath the surface, it’s costing companies far more than most realize.

According to the Association of Certified Fraud Examiners (ACFE) and the Anti-Fraud Collaboration (AFC) in their 2025 Benchmarking Report, the typical U.S. public company loses an estimated 2.5% of its annual revenue to fraud, whether detected or undetected

Here’s the kicker: only about 1% of that is tied to known fraud. The rest—what we call the “hidden 1.5%”—encompasses losses that haven’t yet been discovered, properly quantified, or disclosed.

For attorneys working in commercial crime, shareholder litigation, or regulatory disputes, this number isn’t just a statistic. It’s a signal.

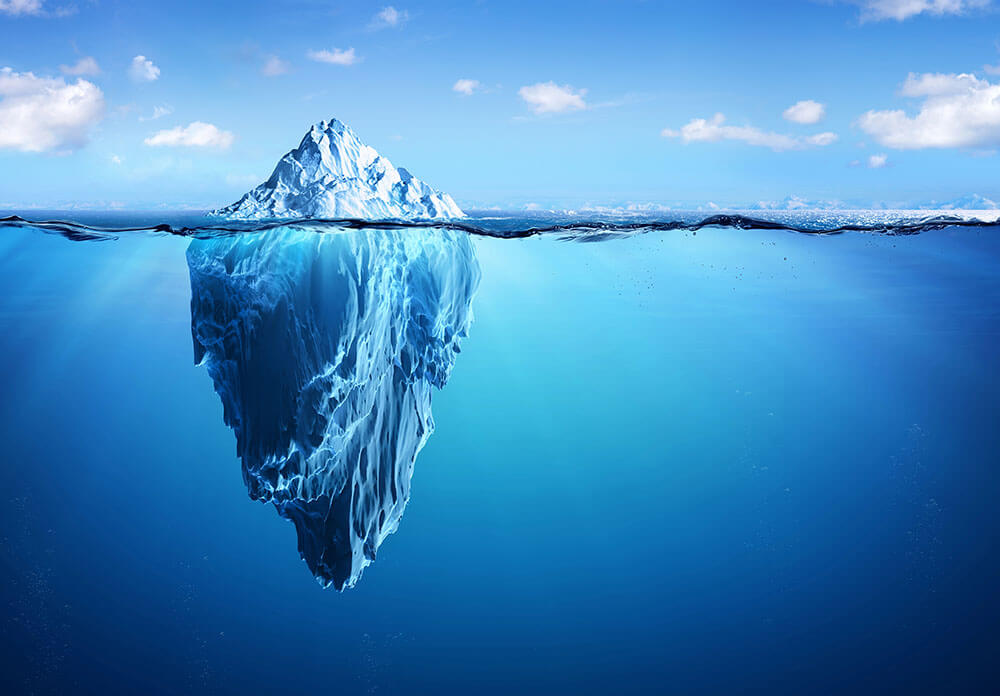

Fraud as an Iceberg Risk

- The visible tip (~1%) refers to losses that are reported, disclosed, or litigated.

- The hidden bulk (remaining ~1.5%) lies beneath the surface—undetected and undiscussed, until whistleblower claims, investigations, or litigation bring it to light.

From a legal perspective:

- Damages assessments may underestimate actual losses.

- Corporate disclosures may understate material risks.

- Settlement discussions may miss the full extent of misconduct.

Understanding this “iceberg effect” is critical when framing arguments about materiality, negligence, or duty of care.

Why Stakeholders Perceive Fraud Differently

The report reveals notable discrepancies in how different groups estimate fraud losses:

- Employees estimate losses at 3% of revenue.

- Governance (boards/audit committees) estimate around 2%.

- External stakeholders (consultants, auditors, regulators) estimate around 4% oig.sc.gov.

Each group views the issue through its own lens. Governance professionals rely on formal reports, employees may observe hidden red flags, while external observers may be more skeptical and less prone to downplay risk.

For attorneys, these perception gaps are pivotal in litigation. The question of “who knew what, and when?” often hinges on whether these blind spots were recognized—or willfully ignored.

Lessons for Private Companies—Even Greater Legal Exposure

The report focuses on public companies, but the lessons extend, and perhaps intensify, for private firms:

- Weaker governance (e.g., fewer independent directors).

- Concentrated authority (e.g., owners doubling as managers).

- Smaller compliance and audit functions.

As a result, fraud is often uncovered only during events such as:

- Bankruptcy and insolvency proceedings.

- M&A due diligence.

- Shareholder disputes.

- Government investigations.

If public companies—under investor scrutiny and with robust controls—lose 2.5%, the exposure for private firms could be even higher. This creates fertile ground for both proactive legal counsel and reactive litigation.

Closing the Gap: What Companies Could Do Better

Survey respondents indicated several interventions that could deter or detect fraud earlier:

- Proactive monitoring and continuous data analytics: 56%

- Better use of technology and AI: 15%

- Stronger fraud culture and employee training: 13% oig.sc.gov

At Ampcus Forensics, we’ve found that fraud schemes often leave digital footprints long before detection—but too many companies lack the tools or willingness to trace them. Creating a proactive detection infrastructure can become a liability issue in court: plaintiffs may cite these gaps as negligence, while defense counsel will need to justify why those safeguards weren’t in place.

Conclusion: A Wake-Up Call for Both Companies and Counsel

The “hidden 1.5%” is more than just a compelling statistic—it’s a warning that fraud is systemic, pervasive, and probably costlier than surface-level numbers suggest.

- For companies: True prevention requires more than compliance—it requires investment.

- For attorneys: Fraud claims often expand as forensic investigations dig deeper. Anticipating the iceberg below the surface can reshape strategy—whether you’re a plaintiff, defendant, or regulator.

As we often say at Ampcus Forensics: fraud is always more expensive than prevention. The only question is whether you’ll pay before or after discovery.